Shipware and Sendflex Remove Parcel Carrier Diversification Risks

More and more shippers are beginning to see the light when it comes to carrier diversification. A multi-carrier shipping approach offers many benefits to brands, from small-volume to enterprise-level parcel shippers, including cost reduction, risk mitigation, time-in-transit, and service improvements.

So, why do some brands still single-source?

We’ve seen a broad range of reasons, from a sense of loyalty (“I’ve shipped Carrier A for 25 years.”) to anecdotal bias (“Carrier B always delivers my package to the wrong address; I just don’t like them.)

However, both in our experience and according to a recent Pitney Bowes multicarrier survey, there are three primary obstacles to carrier diversification that shippers struggle to overcome:

- They are afraid of losing their primary carrier volume discounts

- They don’t have the time to engage new carriers and their incumbent carrier in a lengthy RFP and negotiation process

- They don’t have the proper technology to support multicarrier fulfillment options

This article examines how Shipware and Sendflex provide the expertise and technology to overcome these obstacles.

Risk of losing volume discounts

In general, carriers want most or all of your volume. Sure, there are some exceptions, like large and heavy packages ("ugly shipments"), which carriers will dissuade you from injecting into their parcel networks by levying hefty fees and surcharges, but for the most part, carriers want the bulk of your business. They also want predictable volumes so they can optimize their network planning.

That’s where volume discounts (also known as Earned Discounts, Portfolio Tiers, Tier Incentives, and Revenue Bands) come into play. The more volume you ship with a carrier, the greater the discount on each shipment.

For example, if your annualized transportation spend over a rolling 52-week period falls between $3,500,000.00 and $3,999,999.99, you may receive a 14% discount on Ground Domestic shipping. If you ship more volume and fall between $4,000,000.00 and $4,999,999.99, you may receive a 15% discount. Fall below $3,500,000.00 into the lower tier and your discount may drop to 13%.

The discount tiers paint a clear picture. Save money by shipping more with us. Lose money by shipping less. Shippers’ concerns with losing volume discounts are typically based on a simplified understanding of how carrier discount tiers work.

The reality is, in comparison to the benefits of multicarrier shipping, most shippers receive negligible rewards or penalties for moving up or down discount tiers, respectively.

Carrier agreements contain a number of discount tiers, often seven, sometimes more, sometimes less. Typically, at the time of signing, most shippers fall into a discount tier at the middle of the tier table, where moving up or down a tier results in a 0.1% to 1.0% increase or decrease in service discounts. As they approach the outer ranges of volume/revenue tiers, they’ll find a tier with a slightly larger cliff. You’ll likely find the same in your own agreement(s).

For example, here’s how a FedEx Earned Discount table for Home Delivery Single Piece may be structured:

| Annualized Transportation Charges | Earned Discount |

| $0.00 - $5,749,999.99 | 0% |

| $5,750,000.00 - $6,249,999.99 | 15% |

| $6,250,000.00 - $6,749,999.99 | 16% |

| $6,750,000.00 - $7,499,999.99 | 17% |

| $7,500,000.00 - $7,999,999.99 | 18% |

| $8,000,000.00 - $8,999,999.99 | 22% |

| $9,000,000.00 + | 22.5% |

Here’s how a UPS discount tier for Ground Residential based on weekly transportation charges may be structured:

| Base Weekly Transportation Charges - Bands | Earned Discount |

| $0.00 - $20,499.99 | 0% |

| $20,500.00 - $26,999.99 | 2.20% |

| $27,000.00 - $34,999.99 | 6.20% |

| $35,000.00 - $45,999.99 | 8.20% |

| $46,000.00 - $59,999.99 | 8.70% |

| $60,000.00 - $79,999.99 | 8.90% |

| $80,000.00+ | 9.00% |

Note that outside of the 0% tier, most tiers reflect a 0.2% to 1.0% change in discounts. Shippers with tiers structured like this can divert 10% to 20% of their volume while only losing 1% or 2% of their service discount.

Most shippers don’t approach the tier with the larger (4% in the examples above) discount cliff and only do so in the case of rapid business growth or rapid decline. In those cases, discount tiers become somewhat moot, as the shipper should focus on a complete renegotiation of the carrier agreement to right-size their pricing and discount tiers to minimize losses.

Third-party negotiators like Shipware help businesses leverage their growth and increased volume to renegotiate agreements that result in discounts larger than those received by moving up revenue tiers, even to the highest tier. On the flip side, Shipware helps businesses mitigate higher service rates that come from declining volume.

But, back to the question of losing volume discounts when adding more carriers: yes, you may lose some percentage of discount when shifting volume to a new carrier, depending on how much volume.

However, discount incentives for shifting volume to a new carrier often outweigh the discount penalties from the incumbent carrier. The gains can supersede the losses. Carrier reps are incentivized to win new customers and volume from competing carriers. Shipware’s consulting team, consisting of former carrier pricing management and executives, leverages detailed insider knowledge of carrier rep incentives, pricing models, and benchmarks to further maximize incentives for diversifying volume.

In addition, diversifying even a small portion of volume to other carriers engages that carrier and begins the relationship-building process, which strengthens negotiating positions long-term and protects against service failures.

Remember the summer of 2023 when the UPS Teamsters came alarmingly close to a work stoppage? FedEx threatened to turn away UPS customers who were scrambling to ensure their packages would get delivered in the event of a strike. However, existing FedEx customers were assured their volume would be prioritized if network capacity became an issue. Primarily-UPS shippers that had even a small amount of existing volume with FedEx would have been “safe.”

Sacrificing a discount tier or two to shift volume to another carrier can not only result in overall cost reductions, but service improvements as well. When Shipware works with brands on diversifying, we’re often able to attain discounts on express services the brand previously thought weren’t possible. Those discounts can activate faster shipping options through the new carrier, leading to better delivery times and improved sales.

However, to uncover these opportunities, shippers need to be open to engaging new carriers. Brands can open discussions with carriers themselves to discover surface-level opportunities, but leveraging a pricing consult with specific expertise on carrier agreements and pricing models will unearth deeper discounts and strategic opportunities.

Some shippers have a problem with one of their SKUs taking damage at a higher-than-normal rate. Occasionally, there’s just something about the network that isn’t compatible with their product and/or packaging in a certain region. Those shippers may find that shifting that volume to a regional carrier results in fewer damaged claims, fewer returns, and improved costs.

Working with a consultant like Shipware will help you navigate diversification and loss of volume discounts by supporting negotiations with all carriers, including your incumbent, to ensure a balance that results in maximized cost reductions and service improvements.

Working with a parcel TMS provider like Sendflex will help you operationalize and enforce data-driven carrier selection rules during the order to fulfillment process to ensure you satisfy primary carrier contract incentives and only then take advantage of alternate carrier services. Optimizing intelligent decisions takes the fear out of losing incentives.

A parcel consultant can also help you circumvent minimum commitment clauses, wherein a carrier requires shippers to commit a percentage of their volume or a fixed annual spend to them, and growth clauses, through which a carrier can modify pricing or change the shipment service if their customer grows too much.

Don’t have the time/bandwidth to diversify

Negotiating with carriers is a lengthy process. It can take months to fully optimize an agreement, not to mention with multiple carriers. There are multiple RFPs, multiple bid rounds, financial impact analyses after receiving each bid, and large amounts of correspondence with the carrier rep (who then must correspond with their pricing team), all multiplied by the number of carriers engaged.

Skipping steps and rushing a signature can result in massive overspending. We encounter rushed carrier agreements all the time with rates that benchmark at 20% to 30% above optimized rates.

So, what to do? Some businesses hire logistics professionals, often with carrier-side experience, specifically for the purpose of negotiating with carriers and proactively managing rates.

If that’s not an option (and for most it’s not), working with a third-party negotiator like Shipware, which has negotiated thousands of contracts using proven, tried and true strategies, will free up your team while significantly shortening procurement time. Many consultants offer their RFP and negotiation services with no upfront costs, instead paying themselves with a portion of savings generated, meaning guaranteed cost reductions.

If you want to dip your toes into carrier diversification yourself but don’t have time for a lengthy procurement process and are also concerned with losing volume discounts, you can opt for the “Avoidance Option.” This involves siphoning off any growth in package volume to a new carrier. You engage a new carrier, enhancing your position for future rate negotiations, and sidestep the issue of potentially dropping a discount tier with your incumbent carrier. Just make sure your current carrier agreement doesn’t contain an aforementioned percentage-based minimum commitment clause.

Working with a parcel TMS provider like Sendflex will enable you to simulate the impact new carrier rates and diversification will have on your shipping costs and delivery performance. Using Sendflex's simulator, you can load historical shipping data and compare the old rates with the carrier's new proposed rates. Shippers often find that the proposed rates are higher than a carrier's published GRI estimates. You can also run "what if" scenarios to compare cost and delivery performance with alternative carrier services in conjunction with the new rate structures.

So while rate negotiation and diversification may be time consuming, using Sendflex simulation tools can be a fast way of providing an objective analysis for thoughtful decision making.

Don’t have the proper technology to implement multi-carrier strategies.

With the growth of eCommerce and competitive pressure from Amazon, shippers are implementing omni-channel fulfillment strategies which, together with more complicated rate structures and carrier diversification, are making decisions about when, where, and how to ship parcels more challenging than ever. Especially when shippers are trying to accurately determine costs to control margins during digital storefront, order allocation, and fulfillment processes.

And eCommerce currently accounts for less than 20% of all retail purchases, so the challenges are only beginning.

Unfortunately, most OMS, WMS, and shipping systems were never designed to deal with today's complex parcel fulfillment requirements. They didn't have to. For decades, parcel shipment planning amounted to: "I plan to ship all my packages by UPS (or FedEx)". Tribal knowledge and rules of thumb determined parcel cost calculations when the impact on margins were not as severe.

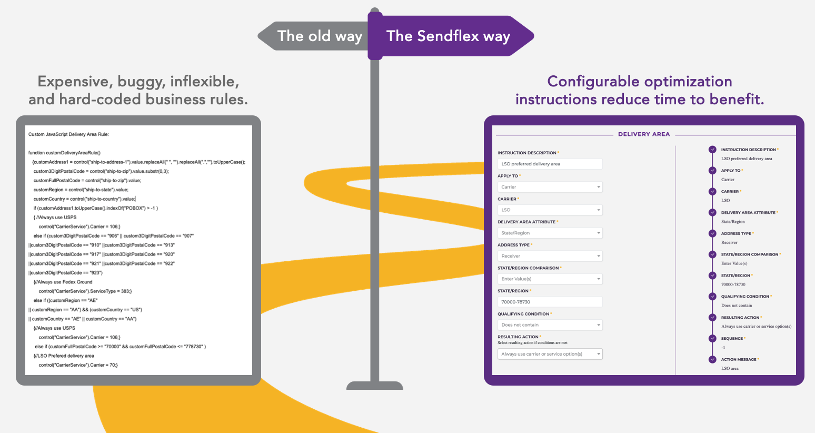

There is a reason why shippers have concerns about whether their current technology can support more sophisticated carrier rate selection decisions. It's because legacy shipping systems require costly and time-consuming custom programming which are difficult to support, maintain, or change.

Sendflex is a next generation parcel TMS platform that makes it easy for business users to easily configure complex business rules which can be applied during order to ship processes. Non-programmers can accomplish in minutes using Sendflex what would otherwise take weeks of hard coding to achieve.

As it relates to carrier diversification, Sendflex monitors carrier spending levels and volumes in real time. Business users can configure business rules to only consider alternative carriers when primary carrier spending levels or volumes are on track to meet discount targets. These instructions can be applied upstream from shipping or at point of shipping.

Best of all, Sendflex's optimization engine includes an API that can work in conjunction with incumbent shipping systems so there is no need to rip and replace existing processes.

Conclusion

By engaging parcel shipping experts like Shipware to diagnose and prescribe cost-saving contractual strategies, and then implementing a parcel TMS platform like Sendflex to operationalize controls, Shippers can reap all the benefits of a multi-carrier solution.

For more information, contact: Sales@Sendflex.com

LEARN

Download

The Five Parcel TMS

Value Pillars

EBOOK

Learn why controlling costs, capacity, carbon, and customer experiences matters in the B2C delivery economy

Shippers who are used to relying on a primary parcel carrier with unlimited capacity must now manage a broader portfolio of carriers, all with different capabilities, performance records, constraints, and rate structures.

DELIVERY CONSULTATION

See What Sendflex Can Do for You

Are you struggling to keep up with the consumer demand for faster, cheaper delivery service options? Is it time for a smart multi-carrier parcel solution?

Whether deployed on premise or accessed from the cloud, our shipping platform apps and APIs support your entire extended enterprise: carrier selection, rating and routing, cartonization, shipping and drop shipping, tracking, and returns.